Reflecting on the Journey of Non-Fungible Tokens (NFTs): The Current State

Reflecting on the Journey of Non-Fungible Tokens (NFTs): The Current State

Key Takeaways

- NFTs rose to popularity in 2021, but their hype has since faded, leading to a decline in the market.

- The NFT boom saw trading volumes reaching billions of dollars, with Ethereum-based NFTs being the most popular.

- NFTs faced challenges such as cybercrime scams, lack of intrinsic value, and poor regulation, leading to a significant drop in their value in 2022 and 2023.

In 2021, NFTs were all the rage. Some of these digital assets sold for millions of dollars to dedicated collectors, even though they had no intrinsic value. Today, the case is very different. NFTs have somewhat faded from mainstream culture, but what lead to this decline? What made NFTs so popular in the first place, and where are they now?

The Origin of NFTs

The history of NFTs (Non-Fungible Tokens) stretches back to 2014, when Quantum, the first-ever NFT , was made. The brainchild of artist Kevin McCoy and his wife Jennifer, Quantum was a digital graphic consisting of a pink and blue hexagon that was soon minted as an NFT after its creation (with the help of Anil Dash). While simple, Quantum marked a moment in history, standing as the origin of an industry that would one day be worth billions.

At this point in time, even cryptocurrencies were still finding their feet. While Bitcoin had amassed a passionate following by 2014, Ethereum had only just been founded, and many of today’s popular blockchains, such as Solana and Cardano, were still yet to be created. It would take another seven years for NFTs to hit their heyday.

The NFT Boom

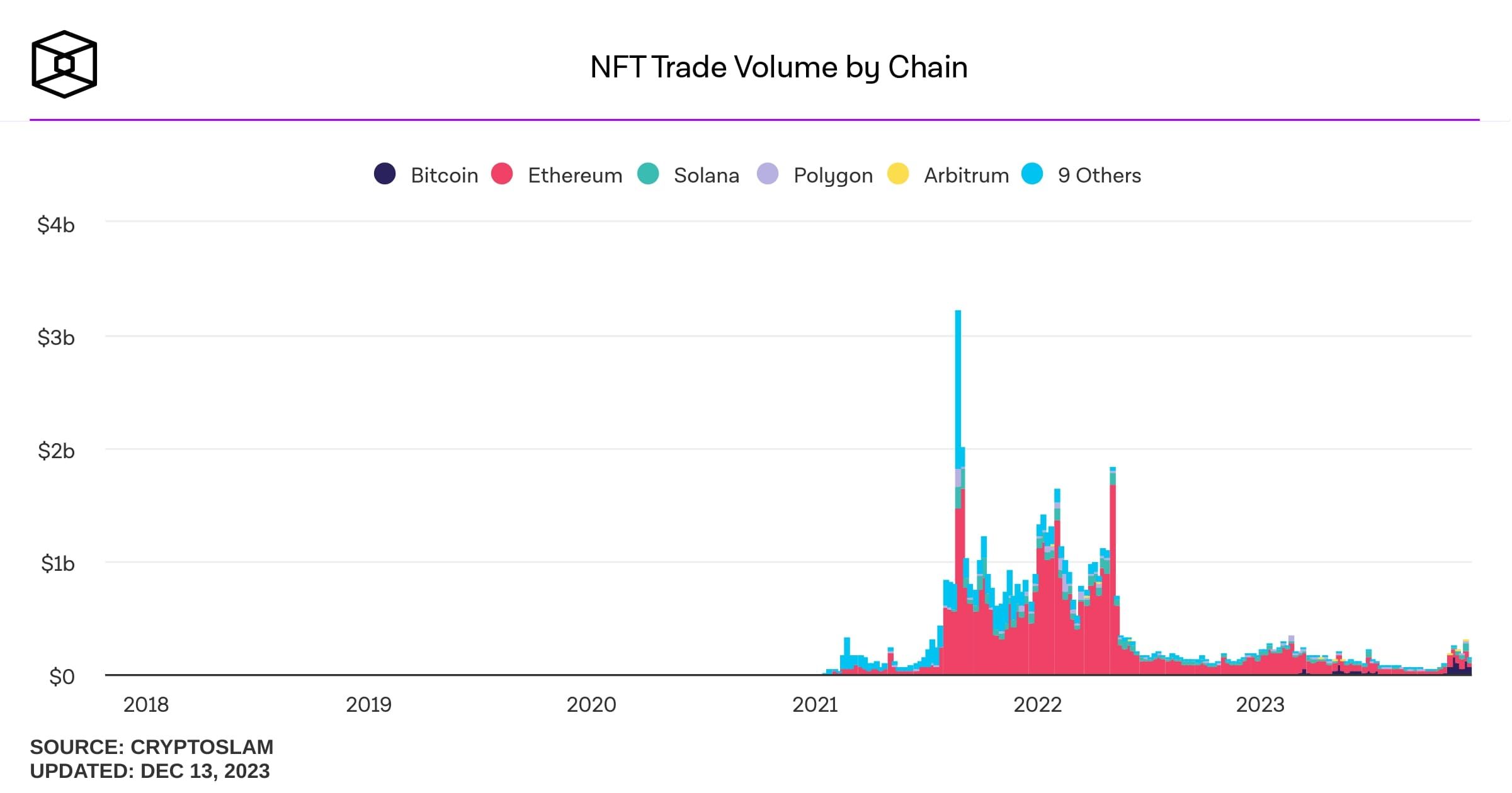

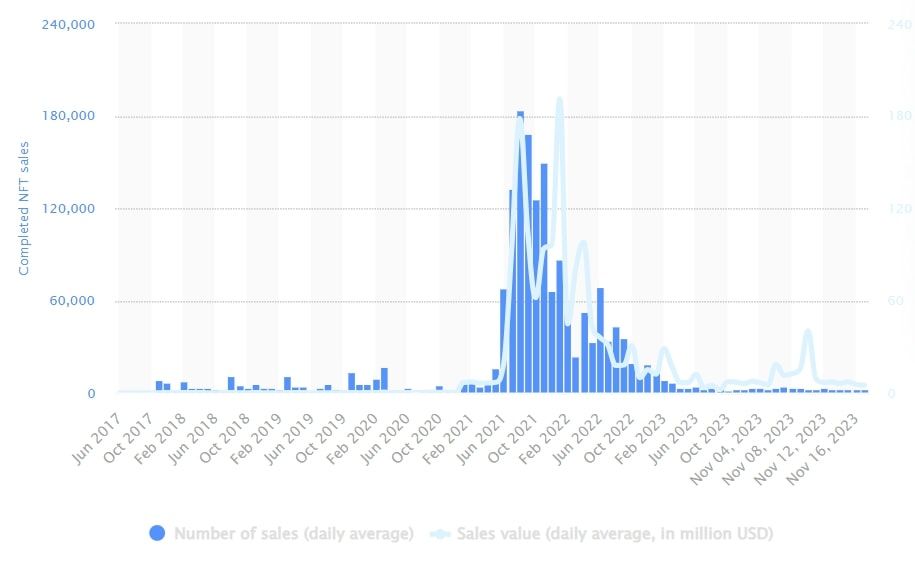

In 2021, NFT sales started ticking upward. As you can see in the chart below (created by The Block ), the trading volume of NFTs started to hit substantial numbers in mid-2021. By the start of 2022, things were looking drastically different to a year prior, with the total NFT trading volume exceeding $1 billion.

The market hit its peak when trading volume exceeded $3 billion. It was never to hit this high point again, but continued to rake in billions for the next year.

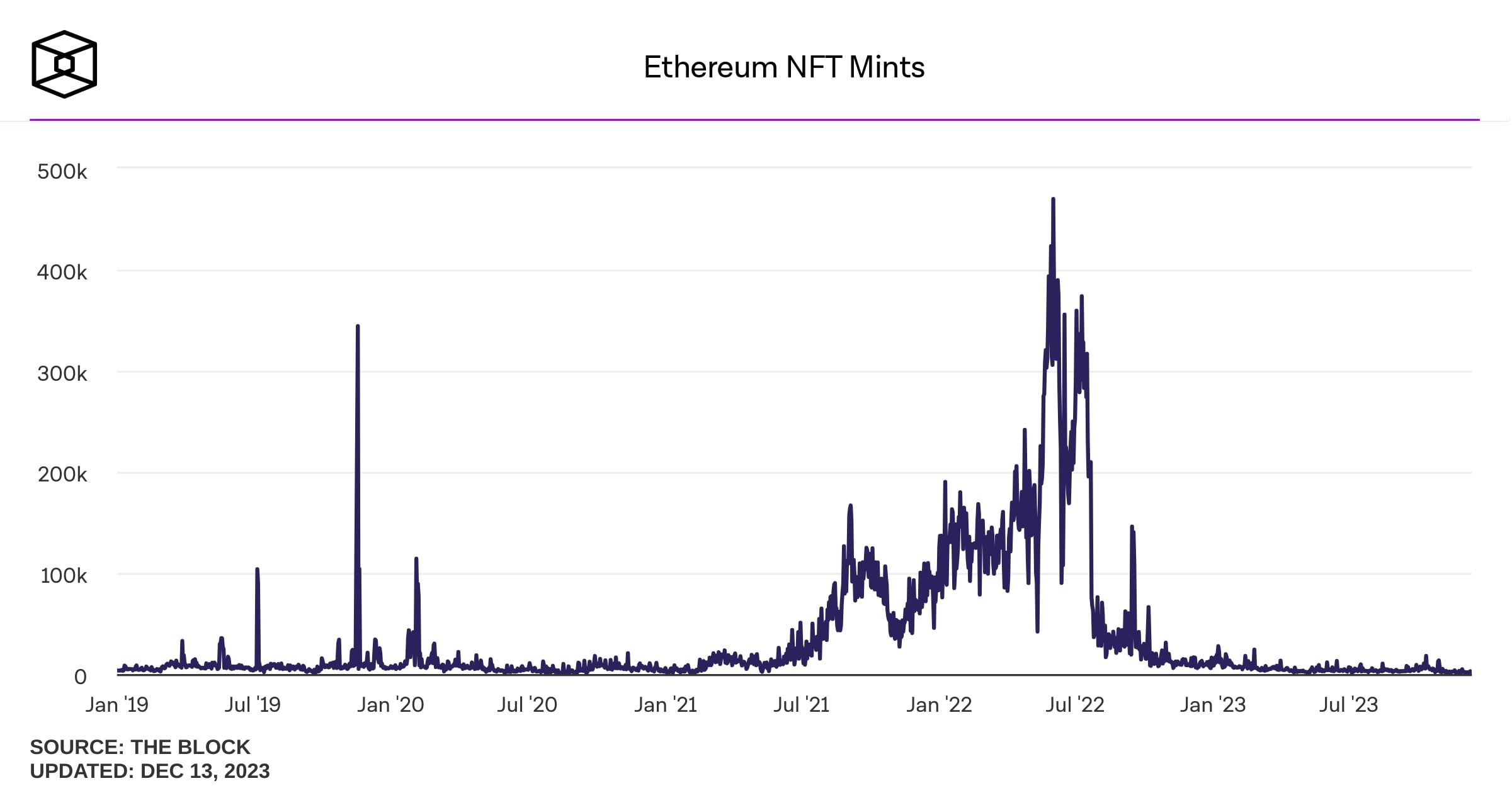

The most popular NFTs are Ethereum-based, and come in the form of ERC-721 tokens. Even today, if you head onto a popular NFT marketplace, chances are you’ll see assets priced in Ethereum. According to the graph below from The Block , the volume of Ethereum-based NFTs being minted shot up in 2022 as the popularity and value of these assets rose.

At the peak of the NFT industry, almost half a million NFTs were being minted daily. This doesn’t even include NFTs from other blockchains, such as Cardano.

The Most Expensive NFTs

With the popularity of NFTs hitting all-time highs, the value of many assets increased steeply. Even if you’re not big into NFTs or crypto, you likely saw some particularly groundbreaking NFT sales hit news headlines in 2021 and 2022.

For instance, in June 2021, an NFT from the well-known CryptoPunks collection sold at the Sotheby’s art auction for $11.8 million . This may seem quite incredible, but things didn’t stop there. Just under a year later, in February 2022, another CryptoPunk NFT sold for $24 million.

Other crypto artworks hit even higher price points. At the end of 2021, an NFT known as The Merge sold for $91.8 million , becoming the most expensive NFT in history. However, this sale involved thousands of collectors, all paying for a fraction of the NFT. With single NFTs being sold for more than some classic artworks, things were looking very good for this new industry.

But the darker side of the internet noticed this booming industry, and, as is often the case, began devising ways to con people out of their money.

The Biggest NFT Hacks and Scams

Since 2021, cybercriminals have conducted some mammoth NFT scams and hacks, be it through rug pulls, back doors, malware, or otherwise.

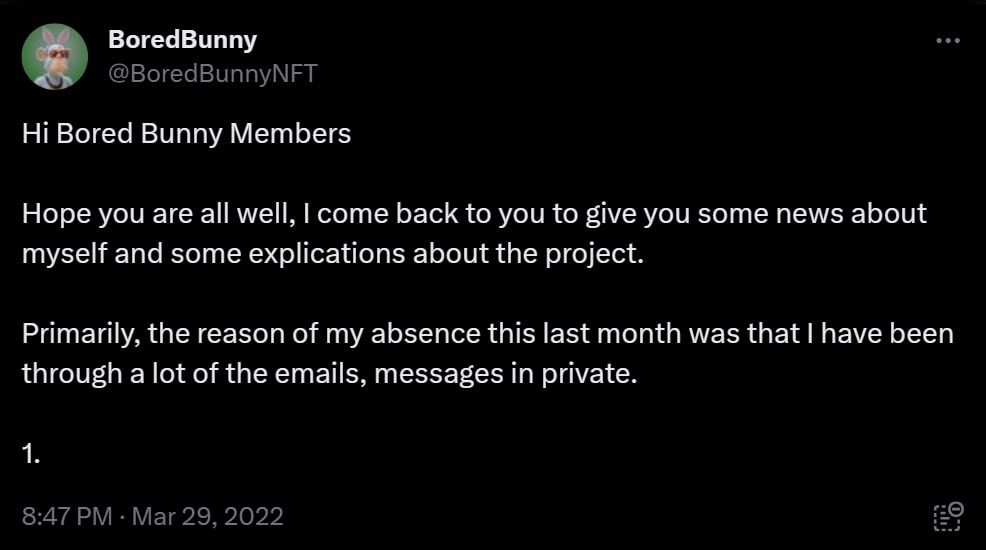

One of the most notable NFT rug pulls was Bored Bunny , a phony NFT project that ended up costing investors $21 million. The collection of almost 5,000 NFTs were all sold to unsuspecting buyers, with sales being fueled when the collection was promoted by influential figures like DJ Khaled and Floyd Mayweather.

As is the case for many crypto rug pulls, the creators of the Bored Bunny collection suddenly went dark on their social media platforms, while the prices of the collection’s NFTs began to fall.

One of the creators eventually posted on X (formerly Twitter), claiming that they’d been busy responding to emails and private messages.

Despite this excuse, the entire project was nothing more than a slow rug pull, a more discrete version of a classic rug pull. This kind of scheme involves the token creators not delivering the token utility promised to investors, essentially making the tokens they bought useless. In the case of Bored Bunny, the metaverse utility and instant profits promised never materialized, giving the NFTs purchased no value at all. The creators managed to gather $21 million in the process, leaving investors out of pocket.

A number of other NFT rug pulls gained notoriety by imitating the artworks from the highly popular Bored Ape Yacht Club (BAYC) collection. Scam collections like Baller Ape Club and Evolved Apes piggybacked on BAYC’s name to lure in investors, with the creators soon hitting the road with the funds amassed.

Hacks also gave cybercriminals access to valuable NFTs during the industry’s boom. Because a lot of NFTs are stored in hot (online) wallets, attackers can steal them via remote hacks. For instance, almost $19 million in Lympo NFTs were stolen in a hot wallet attack in January 2022.

Phishing is also a common tactic in the NFT crime realm, and is often used to steal passwords, private keys, and seed phrases. Even well-established NFT projects and platforms have been hit by phishing attacks, including OpenSea. This widely popular NFT marketplace was successfully targeted in February 2022 when users were conned out of their ETH through phishing emails. While the hacker surprisingly returned a portion of the NFTs, funds were still lost, and many users were still left without what they lost.

The Fall of NFTs

NFTs have always been highly controversial , mainly due to the instability of their value. A given NFT can amass value through two factors: demand and utility. An NFT may not have any utility, but if it’s coveted enough (usually through online hype and marketing), it can reach a high value. On the other hand, if an NFT has utility, such as value in a game or metaverse project, it can also amass value.

However, the majority of highly expensive NFTs have sold at such high price points because of online hype. Cryptopunks, for example, have no utility at all. Rather, being one of the first Ethereum-based NFT projects gave the collection notoriety. After buying a Cryptopunk, there’s no way of using it as an in-game currency, ticket, or other kind of asset. At the end of the day, it’s just a piece of digital art with a signature attached to a blockchain token.

This fact always put the NFT industry in a precarious spot. Once people no longer found NFTs interesting or alluring, the fall in demand would have a domino effect on value.

By the end of 2022, the NFT market was still prominent, but had lost a significant amount of value. Links to cybercrime, a lack of intrinsic value, poor regulation, and mistrust in technology all contributed to this decline. What’s more, the crypto market crash of November 2022 (mostly fueled by the FTX exchange scandal) also had a domino effect on the NFT market, as the two are closely tied.

Going into 2023, things weren’t looking good for NFTs. Between 2022 and 2023, the average price of NFT sales dropped by 92 percent, according to a Chainalysis report . This meant that an NFT once worth $1,000 was now only worth $80. Evidently, things had gone quite sour for the NFT market. NFTs can still hold value, but their current prices pale in comparison to those of 2021 and 2022, as is evident via the aforementioned Chainalysis statistic.

The NFT Industry Today

2023 has shown just how fragile the NFT industry is.

As shown in the Statista graph below, the NFT sale volume throughout 2023 is dwarfed by the figures seen in 2021 and 2022.

As of October 2023, a daily average of 2,031 NFT sales were taking place. A year prior, this figure stood at almost 39,000. A year before that, it stood at 183,755. The NFT market we see today is worth a fraction of what it was in previous years, and there’s no knowing if it will ever recover.

NFTs May Have Been a Brief Craze

No one is sure of what the future holds for NFTs, but its steep growth and extreme decline represent how volatile these assets, and therefore the industry, really are. One day, NFTs might regain some, if not all of their previous notoriety. But for now, they remain a niche market with a limited clientele.

Also read:

- [New] Elite Recording Tech Top 10 Cam Devices Windows 11 for 2024

- [Updated] 2024 Approved Multiplying Joy Sharing a Pile of Photos & Videos with Instagram

- [Updated] 2024 Approved Spotlight on Starlet's Snippet

- [Updated] Essential, Inexpensive Vlogging Tools Listed for 2024

- All About Google Pixel Timepiece Gen3: Detailed Review of Specs, Functionalities, Costs, and Essential Info Covered

- Best Ways on How to Unlock/Bypass/Swipe/Remove Lava Fingerprint Lock

- Earbud Showdown: Galaxy Buds 2 Pro, Pixel Buds Pro & AirPods Pro Face Off for Audio Supremacy | TechSavvy

- Essential Guide: Configuring Gmail Alerts for Uninterrupted Inbox Management | ZDNet

- In 2024, Easy Ways to Manage Your Samsung Galaxy A54 5G Location Settings | Dr.fone

- In 2024, The Essential Differences Between YouTube and DailyMention

- Mastering Email Composition in Google Docs: A Comprehensive Guide by ZDNet Experts

- Title: Reflecting on the Journey of Non-Fungible Tokens (NFTs): The Current State

- Author: John

- Created at : 2024-12-19 16:05:46

- Updated at : 2024-12-25 21:54:48

- Link: https://techno-recovery.techidaily.com/reflecting-on-the-journey-of-non-fungible-tokens-nfts-the-current-state/

- License: This work is licensed under CC BY-NC-SA 4.0.